Agi For Roth Contribution 2025 - Learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings. Amount of your tax credit based on income and filing status for 2025. Can I Recharacterize A Roth Contribution In 2025 Suki Marcille, It is tiered, meaning that as your agi increases, the amount you can contribute to your. To max out your roth ira contribution in 2025, your income must be:

Learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings. Amount of your tax credit based on income and filing status for 2025.

2025 Roth Ira Agi Limits Nari Tamiko, You can leave amounts in your roth ira as long as you live. Amount of your tax credit based on income and filing status for 2025.

Roth Ira Contribution Limits 2025 Salary Cap Irena Leodora, The income limits for the roth ira apply only to roth ira contributions, so you could still contribute to a traditional ira up to the $6,500 (or $7,500) limit for 2023, and $7,000 (or. Income limit for a full roth ira contribution.

2025 Roth Ira Agi Limits Bella Carroll, The annual ira contribution limits are divided into a limit for those under 50 and those over age 50. For 2025, the limit is $7,000 for those under 50, an increase.

File 2023 federal individual income tax return (or make payment with extension) make 2023 contribution.

Individual retirement accounts (iras) are a common source of income among. You can make contributions to your roth ira after you reach age 70 ½.

2025 Roth 401k Limits Elsa Ardella, You must have earned income to be eligible for a roth ira. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

The roth ira contribution limits increased in 2023 and are moving up again in 2025.

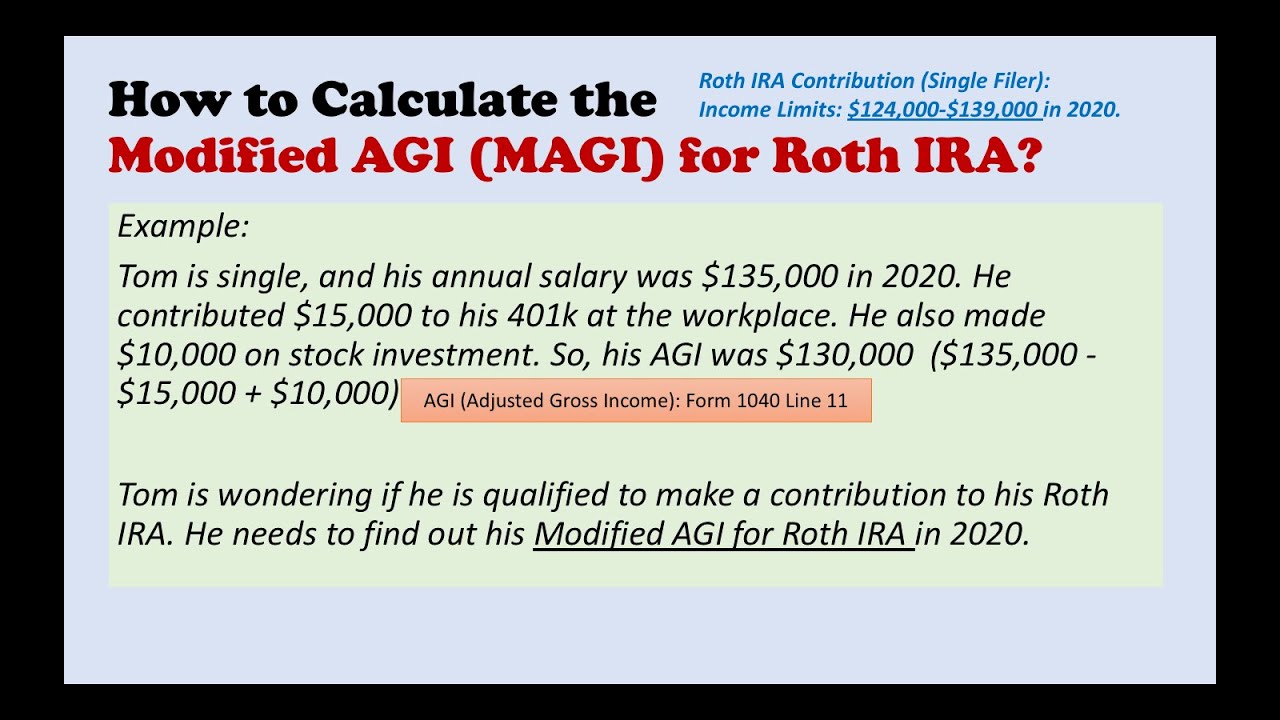

Roth Agi Limits 2025 Eran Odella, In 2025, the roth ira contribution limit is $7,000, or. There are several ways to reduce your 2023 modified adjusted gross income to help you qualify to make roth contributions.

Roth Contribution Limits 2025 Agi Shani Melessa, The roth ira contribution limits increased in 2023 and are moving up again in 2025. Modified agi limit for roth ira contributions increased.

Roth Ira Amount 2025 Morna Tiertza, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000. The roth ira contribution limits increased in 2023 and are moving up again in 2025.